There was a fall in the prices of Solana Sol tokens after attackers were able to exploit the vulnerability on Wormhole. It is a popular bridge that exists between the networks of Ethereum and Solana. Bridges are gateways or tools used to transfer data and assets between two separate blockchains.

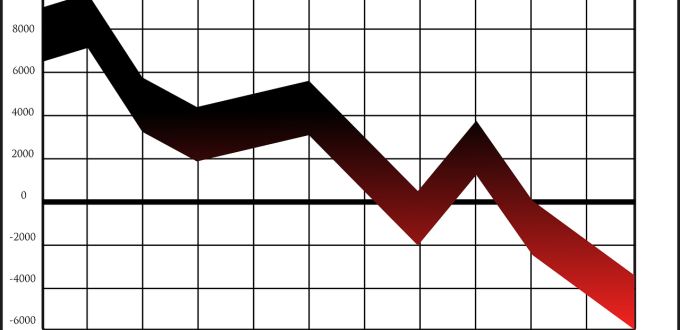

In the last 24 hours, there was a fall of more than 10% in the prices of Solana and was trading at $95.77 at the time of writing.

According to the data provided by analytics toll Coinglass, around $13 million worth of liquidation occurred on futures tracking SOL. Out $13 million, more than $5.6 million occurred at crypto exchange Binance, and $4.26 million on FTX. Liquidation occurs when a trader doesn’t have the necessary funds required to keep a leveraged trade open.

The fall in prices occurred after the exploitation of the Wormhole on Wednesday evening. The hack was confirmed by the Wormhole during early Asian hours on Thursday. Through a tweet Wormhole informed that “they will add ether over the next hours to ensure wrapped ether (wETH)- a representation of ether on Solana- was backed on 1:1 basis with ether to prevent malfunctioning of decentralized exchange (DeFi) applications”.

Smart contracts are implemented by DeFi applications to provide financial services such as trading, lending, and borrowing to users.

In the hack the attackers were able to steal over 120,000 wETH by tricking a series of smart contracts on Solana to digitally sign, allowing an illegal transaction.

Disclaimer: The article should not be considered as any financial advice. It is advisable to cond

photo by – Clker-Free-Vector-Images on Pixabay